The Tax Department (DIMP) is a government department with the task of guaranteeing tax revenues and facilitating taxpayers in meeting tax obligations.

It is a task with enormous responsibility, not only for the budget of the country of Aruba but also for other government entities such as ATA. TPEF, AZV, SVB, DIMAS and DIP.

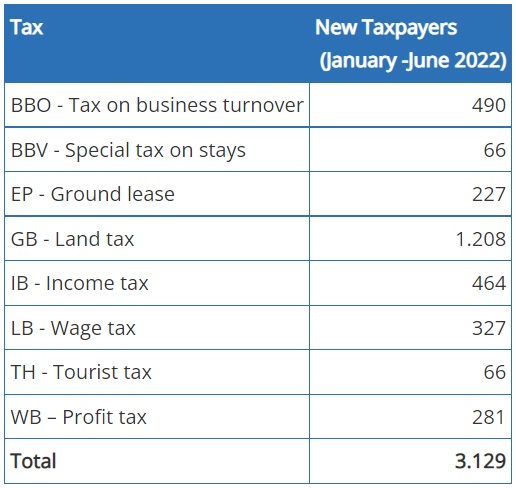

Before levying any tax, it is imperative to identify and register individuals and/ or companies that generate income for which they are subject to tax. It is a routine job of the tax authorities. In the first half of 2022, the DIMP registered 3,129 new taxpayers.

Registration department

The DIMP has its Registration Department in charge of the registration of private individuals and companies. This department must continuously optimize its register to keep it up-to-date.

This registration process may seem simple but is more complex as it requires strict control of the information received. The department checks the documents and proof of identity before being able to register the data in its digital system. The DIMP must work closely with the Civil Registry Office (Censo), Chamber of Commerce, DOW, DIP, Land Registry and Mapping Agency, DIMAS, SVB, and ATA to verify the data.

These figures indicate what efforts the DIMP must continuously make in the compliance concerning the various types of taxes.

The DIMP receives a lot of information for new registrations daily. They often receive it from individuals or companies but also other sources. The DIMP may receive anonymous information about individuals or companies that clandestinely receive income that is not subject to tax. An investigation will start with the help of, for example, the FIOT, to eventually register those who do not comply with their tax liability.

Once the person or company is registered, it has the responsibility to meet the tax obligations and must file tax returns and make the corresponding payments on time. This way, they contribute to the land treasury and the well-being of the country of Aruba.