In line with the Monetary Policy Committee’s (MPC) task to evaluate, determine, and provide transparency on the monetary policy actions of the Central Bank of Aruba (CBA), the CBA communicates the following.

During its meeting on November 22, 2022, the MPC decided to increase the reserve requirement from 24.0 percent to 25.0 percent as of December 1, 2022. Accordingly, commercial banks must hold a minimum balance at the CBA equal to 25.0 percent of their clients’ short-term deposits. The decision to expand the reserve requirement to 25.0 percent was based mainly on the diminished pace of decline in the commercial banks’ excess liquidity, as well as the still ample level of excess liquidity at the commercial banks, which persists well above the pre-pandemic and precautionary levels.

The MPC considered the following information and analysis during its deliberation:

International and official reserves

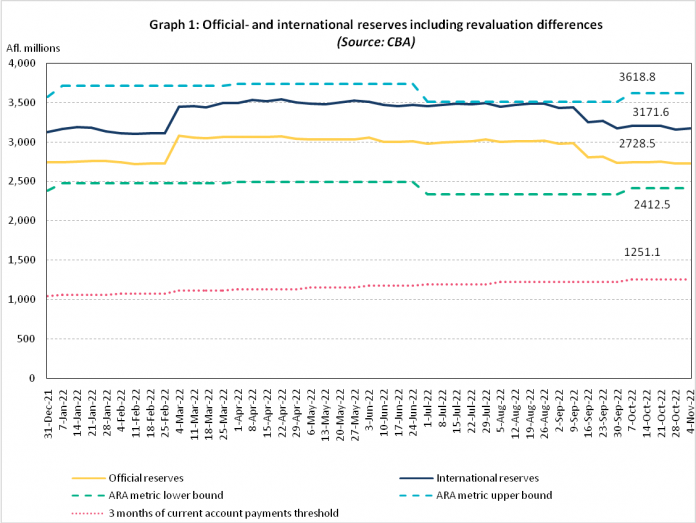

The international reserves, comprising the official reserves of the CBA and foreign reserves held by the commercial banks, grew by Afl. 42.0 million (Graph 1) on November 4, 2022, compared to end-December 2021. Official reserves contracted by Afl. 16.4 million, while the foreign reserves held by the commercial banks widened by Afl. 58.5 million. Consequently, on November 4, 2022, official and international reserves stood at Afl. 2,728.5 million and Afl. 3,171.6 million, respectively. For the rest of 2022, the CBA expects strengthened international and official reserves due to increased foreign exchange inflows from tourism.

Maintaining reserve adequacy is critical to keeping the fixed exchange rate between the Aruban florin and the US dollar. In this regard, the CBA anticipates international reserves to remain comfortably above the minimum required three months of current account payments. Among others, current account payments consist of import payments, interest payments made to investors, and foreign transfers such as money remittances by foreign workers.

Official reserves are forecasted to stay within an adequate range when benchmarked against the International Monetary Fund’s (IMF) Assessing Reserve Adequacy (ARA) metric.