By SARAH SKIDMORE SELL

Associated Press

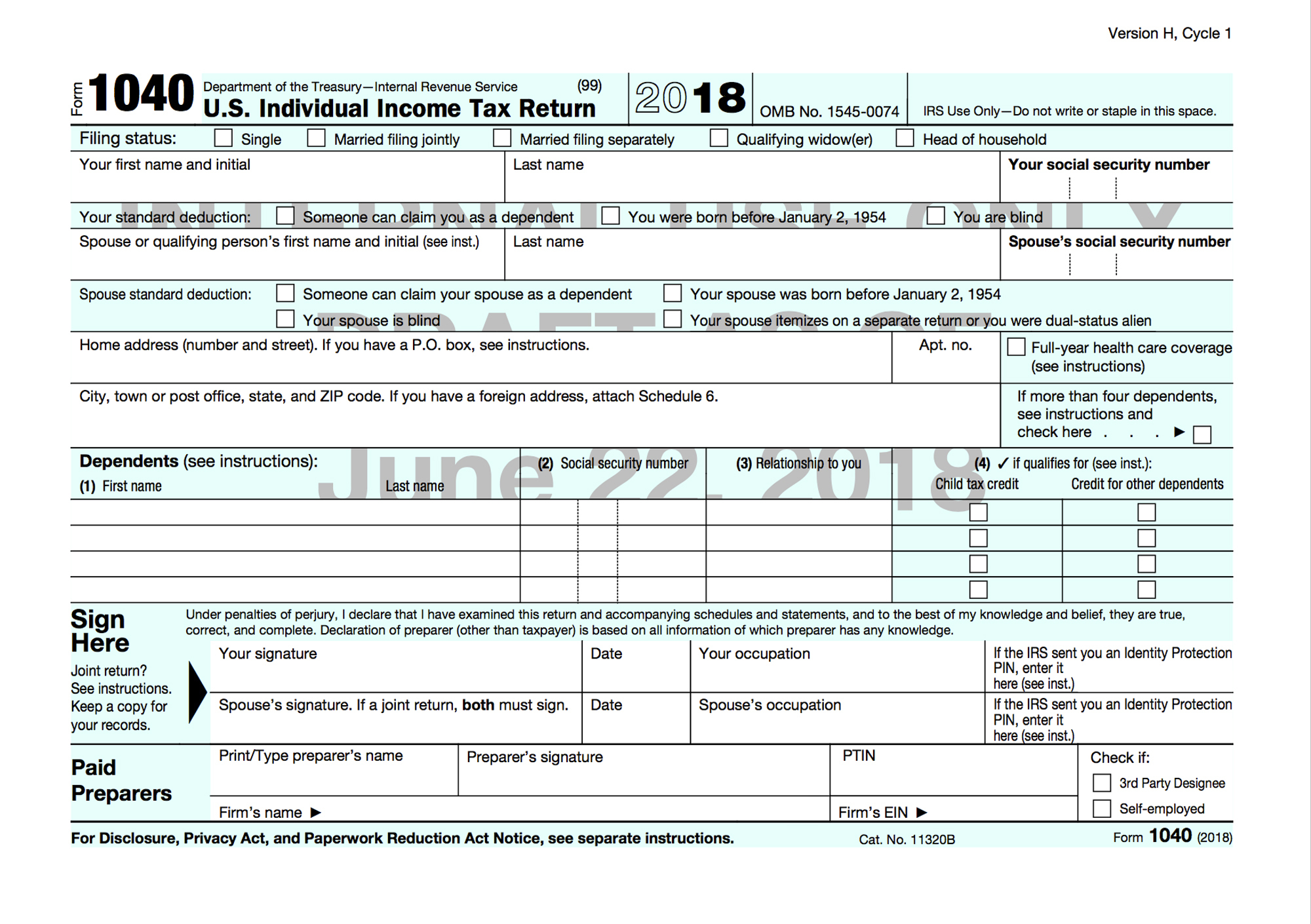

The Trump administration may deliver on its promise to reduce a commonly used tax form to postcard size, but it does not shrink the workload for many Americans filling out their taxes. A draft copy of the new 1040 income tax form given to The Associated Press by a staffer on the Ways & Means Committee shows that the form will be reduced from two full pages to a double-sided half page. But the legwork to claim many popular deductions and provide other critical information has been moved to one of six accompanying worksheets.

The postcard-sized form was a big selling point for the administration during its promotion of the divisive new tax law — President Donald Trump even kissed a version of the postcard at one meeting to show his approval. Experts say that while the law does simplify the process for some Americans, many will still have to go through the same hoops to complete their taxes with this new format. The tax law greatly increases the standard deduction, meaning that millions of Americans will claim the deduction and skip the time-consuming process of itemizing on their taxes.

The Tax Policy Center estimates that about 27 million fewer taxpayers will itemize under the new law. Taxpayers may still need to crunch the numbers to see if they should itemize or not. And, 19 million filers will continue to itemize, according to TPC, so they will still need to fill out one or more of the six additional forms. The supplemental paperwork would be needed to make common tax moves, such as a reporting an educator expense or claiming a deduction for interest paid on a student loan, as well as reporting childcare expenses and retirement savings contribution credits.

“Don’t confuse creating a postcard with simplifying a tax filing, it’s not the same thing at all,” said Howard Gleckman, a senior fellow at the Tax Policy Center. Gleckman said that most taxpayers are going to have to fill out one, if not more of the new accompanying forms. And the new structure makes some beneficial components of tax law, such as the ability to claim the earned income credit — which is designed to help low to moderate-income working people — harder to find. The postcard is more of a concept than practice anyhow.

The bulk of taxpayers complete their taxes online, meaning they still answer all the same questions regardless of how the paperwork is laid out. And unlike a postcard from vacation, those that fill out their taxes on a postcard will likely want to send it in an envelope to protect their private information on the document, such as their Social Security number. “I am not sure this is going to make a whole lot of difference,” Gleckman said. The Treasury was expected to unveil the new form this week and did not immediately comment on the draft document. The IRS also did not comment.

A failure to dramatically simplify the tax filing process as promised may earn criticism from Democrats who mightily opposed the $1.5 trillion tax plan, which cut taxes for many Americans but gave its biggest benefits to corporations and wealthy individuals. Rep. Lloyd Doggett, D-Texas, who is a member of the House Ways and Means Committee and a fierce critic of the tax law, said in a statement Tuesday that the postcard “only adds needless complexity and confusion.” “Why stop at a postcard?” he said. “(Why not) make it a postage stamp, with a catalogue of schedules required to complete filing?”