During its meeting of March 2, 2021 and after reviewing the most recent economic and monetary data, the Monetary Policy Committee (MPC)[1] of the Centrale Bank van Aruba (CBA) decided to keep the reserve requirement at 7.0 percent. The reserve requirement refers to the minimum amount of reserves that commercial banks must hold at the CBA and is equal to 7.0 percent of their liabilities with a maturity less than 2 years. The following information and analysis were considered in reaching this decision.

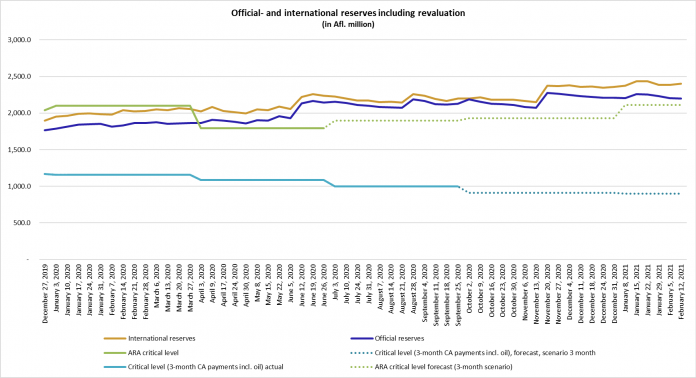

International reserves

International reserves (including revaluation differences of gold and foreign exchange holdings), up to and including February 12, 2021, strengthened by Afl. 47.7 million compared to the end of December 2020. This expansion was primarily the result of external financing received by the government during the first month of the year and inflows related to tourism services, and other external financing. Meanwhile, official reserves decreased by Afl. 9.1 million. Consequently, the official and international reserves reached, respectively, Afl. 2,198.8 million and Afl. 2,404.3 million as of the 12th of February 2021. Accordingly, the level of reserves remained adequate when benchmarked against the current account payments and the ARA[2] metric by the IMF.

Credit developments

In January 2021, total credit grew by Afl. 18.0 million or 0.5 percent, when compared to the end of 2020. This was mainly driven by the category ‘business loans’, which recorded an expansion of Afl. 27.5 million (+1.8 percent), as current account loans noted an uptick. Contrarily, the components ‘other’ (Afl. –4.7 million/-0.9 percent) and ‘loans to individuals’ (Afl. -4.8 million/-0.3 percent) contributed negatively to total credit. The category ‘loans to individuals’ fell mostly as a result of contractions in consumer credit (-0.9 percent), and to a lesser extent due to housing mortgages (-0.1 percent). Remarkably, housing mortgages noted their first reduction since January 2017.

Inflation

The CPI was 2.7 percent lower in January 2021, compared to the corresponding month a year earlier. This was mainly attributed to lower prices in the categories ‘household operation’ and ‘transport’. The 12-month average inflation rate continued its downward trend reaching -1.8 percent in January 2021. When excluding energy and food, the 12-month average core inflation rate stood at -0.4 percent in January 2021.

Prudential liquidity

The prudential liquidity of commercial banks (33.5 percent), which measures the amount of their liquid assets to their total net assets, remained at a comfortable level in January 2021, far above the minimum required prudential liquidity ratio (15.0 percent).