In the months of May and June, Aruba Tourism Authority carried out a survey in order to find out the perception among the local residents regarding tourism – both positive and negative, focusing on the aspects of economic and social development.

This survey was based on questions asked to residents back in 2017 in a similar survey.

Originally, these questions were used in a survey among the residents of Hawaii regarding their perception of tourism. It was decided to expand the survey in 2022 with additional questions compared to 2018.

It is important to note that while not everything that was brought forward in the survey falls under the main responsibility of A.T.A. as Aruba’s Destination Marketing and Management Organization (DMMO), the opinions and suggestions received do help to direct actions that do fall under the umbrella of A.T.A. and help A.T.A. in its role as advisor and guide to other organizations in the desired tourism development. A.T.A. values the inclusion of the community when it comes to tourism, and whenever possible, will invite the community to be part of the conversation and the results.

The residents were encouraged to complete the survey both virtually and on paper. The organization managed to collect 2811 responses, however, after excluding the responses of people who were not residents of Aruba and the responses that were incomplete, a total of 1983 valid responses was reached.

In 2018 a profile for each generation was created in order to have a better understanding of the different opinions among different groups of residents. These profiles were used once again to analyze the results of 2022. For this survey, quantitative as well as qualitative data was analyzed.

The respondents were 35% male and 65% female. The largest group of respondents was between 30 and 39 years old (25%). The district with the most respondents was Paradera/Santa Cruz (30%). Of the respondents, 39% is married, and 80% is employed.

In 2005, the Chamber of Commerce (KvK) carried out a study in order to find out what was more important for our residents, between economic and social development. 48% of participants answered social development while 52% answered economic development. In 2018, A.T.A. used KvK’s question in its survey – and here it was noted that 60% of respondents chose social development while 40% chose economic development. In 2022, social development was chosen by 56% of respondents while 44% chose economic development.

Of those who chose economic development, 52% indicated that the expansion of industry unrelated to tourism is the most important aspect for economic development. Of those who chose social development, 41% indicated that more social assistance is the most important aspect.

Comments relating to the two types of development were properly categorized. For economic development, the largest amount of comments referred to more economic pillars, finances and product improvement. For social development the largest amount of comments referred to more focus on the community and the social aspect, balance and education.

Various questions were asked in which participants had to indicate between 1 and 5 their feeling on various topics, with 1 being extremely negative and 5 being extremely positive. From 1 to 5, respondents indicated with an average of 3.8 that tourism has a positive impact on Aruba in general. Respondents indicated with an average of 3.6 that tourism has a positive impact on them and their families. Respondents indicated with an average of 2.2 that their purchasing power for the next twelve months has been negatively impacted compared to before the pandemic.

The responses were analyzed also comparing different generations. The respondents were asked to indicate between 1 and 5 if their island is too dependent on tourism. The lowest average here was 4.42 for Baby Boomers, the highest was 4.70 for Gen Z.

Regarding the question if respondents feel that they have a voice in the tourism decisions on their island, between 1 and 5, the lowest average was 2.02 for Millenials, and the highest was 2.19 for Baby Boomers.

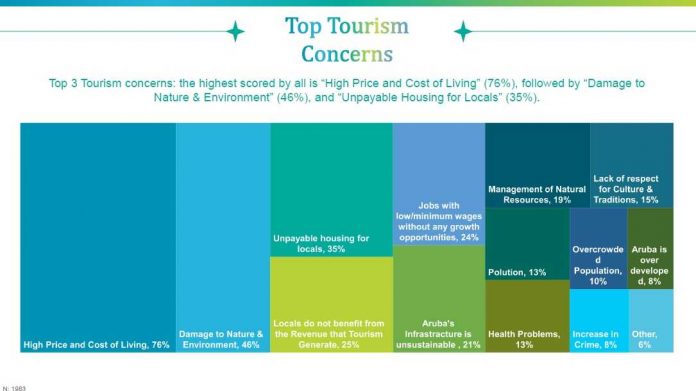

Respondents were asked to share their 3 main worries regarding tourism: 76% indicated the high prices and the high cost of living; 46% indicated damage to nature and the environment; and 35% indicated unaffordable housing for residents.