In line with the Monetary Policy Committee’s (MPC) task to evaluate, determine, and provide transparency on the monetary policy actions of the Central Bank of Aruba (CBA), the CBA communicates the following.

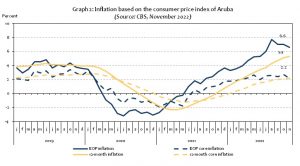

During its meeting on January 13, 2023, the MPC decided to maintain the reserve requirement rate at 25.5 percent as of February 1, 2023. Accordingly, commercial banks must hold a minimum balance at the CBA equal to 25.5 percent of their clients’ short-term deposits. The decision to maintain the reserve requirement rate at 25.5 percent was based on the steady decrease in the excess liquidity held at commercial banks, albeit at a lower pace, since July 2022. The CBA will continue to monitor the developments of excess liquidity in the coming months and stands ready to again change the reserve requirement rate, if deemed necessary.

The MPC considered the following information and analysis during its deliberations:

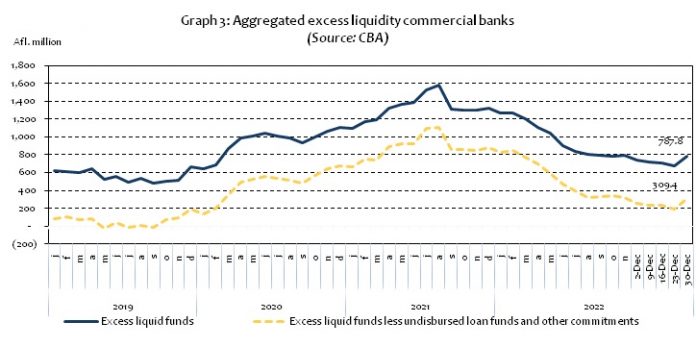

International and official reserves

The international reserves, comprising the official reserves of the CBA and foreign reserves held by the commercial banks, grew by Afl. 111.6 million as of December 30, 2022, compared to end-December 2021 (Graph 1). Official reserves expanded by Afl. 46.0 million, while the foreign reserves at the commercial banks widened by Afl. 65.6 million. Consequently, as of December 30, 2022, official and international reserves amounted to Afl. 2,790.9 million and Afl. 3,241.2 million, respectively.

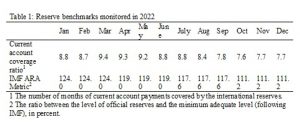

Maintaining reserve adequacy is critical to keeping the fixed exchange rate between the Aruban florin and the US dollar. In this regard, international reserves remained comfortably above the minimum required three months of current account payments during 2022. Current account payments consist, among others, of import payments, interest payments made to investors, and foreign transfers such as money remittances by foreign workers. Official reserves also stayed within an adequate range when bench marked against the International Monetary Fund’s (IMF) Assessing Reserve Adequacy (ARA) metric (Table 1).

Inflation

In November 2022, the End-of-Period (EOP) inflation rate fell from 7.0 percent in the previous month to 6.6 percent (Graph 2). The jump in the consumer price index (CPI) compared to the same month of the previous year was caused by higher utility prices, which affected the ‘housing’ component (2.7 percentage points contribution). Moreover, gasoline prices surged, mainly impacting the ‘transport’ component (1.7 percentage points contribution), while prices in the ‘food and non-alcoholic beverages’ component also accelerated (1.4 percentage points contribution).

The 12-month average inflation rose to 5.3 percent, up from 5.1 percent in October 2022. The inflationary pressures were due to the elevated oil price in international markets, as well as the hikes in water and electricity tariffs as of August 2022. Furthermore, Aruba imported much of the soaring prices from its export partners, particularly the United States and Europe.

Meanwhile, in November 2022EOP core inflation (excluding energy and food) reached 2.2 percent. On a twelve-month average basis, core inflation also amounted to 2.2 percent.

Commercial bank excess liquidity

Aggregated excess liquidity fell from Afl. 1,320.5 million in December 2021 to Afl. 796.9 million in November 2022 (Graph 3). This drop was principally due to consecutive hikes in the reserve requirement from January 2022 up to and including July 2022. Moreover, preliminary estimates based on weekly data for December 2022 showed a further contraction in excess liquidity. End December 2022, excess liquidity is estimated to have fallen to Afl. 787.8 million. Nevertheless, excess liquidity remained above the pre-pandemic level of February 2020 (+Afl. 98.7 million), and higher than the level that the commercial banks may wish to hold as a safeguard. When excluding undisbursed loan funds and other commitments excess liquidity still stood at an estimated Afl. 309.4 million in December 2022.