Today, the Centrale Bank van Aruba (CBA) published the State of the Economy report for the second quarter of 2022. The publication contains national, as well as international economic developments. The highlights of this publication are presented below.

In the second quarter of 2022, the economy of Aruba continued on a growth track compared to the same period in 2021. The 5.7 percent growth in real GDP derived from the lasting positive momentum in Aruba’s tourism sector. Measured indicators for investment and consumption demonstrated an increase in economic activity.

This persistent recovery was connected to an increase in stay-over visitors and nights, which boosted hotel operations (Table 1). In the first half of 2022, Aruba saw a 61.9 percent climb in stay-over visitors compared to the first half of 2021, and reached 91.8 percent of 2019 pre-COVID-level. A surge in U.S. arrivals (+46.5 percent) fueled the high number of stay-over visits, along with growth in all markets. The increased tourism demand caused a rise in occupied room nights (+63.1 percent) and other hotel sector indicators. Aside from stay-over visitors, cruise visitors also contributed to the recovery, registering a growth of 16,481.0 percent year-on-year.

Most consumption-related indicators were positive, pointing to a rise in consumption. Two of these indicators, being turnover taxes (+33.1 percent) and commodity taxes (+21.0 percent), soared due to a combination of the elevated level of tourism activity and an uptick in domestic consumption (Chart 1). The increase in consumption was noticeable in Aruba’s trade deficit, which widened by Afl. 263.5 million, resulting from the surge in import (+31.3 percent) on account also of higher import prices.

Furthermore, investment indicators largely showed improvement compared to the first half of 2021. Among these indicators, the value of imported base metals and derivated works grew by a notable 39.3 percent in the first half of 2022 (2021 Jan-Jun: -9.8 percent), while the value of imported machinery and electrotechnical equipment surged by 23.6 percent (2021 Jan-Jun: +6.2 percent). Additionally, in the first half of 2022, new commercial and housing mortgages demonstrated expansions in both value and number compared to the first half of 2021.

In line with international price developments, the consumer price index (CPI) remained on its upward trend reaching 103.3 in June of 2022. The 5.3 percent climb in the end-of-period inflation was primarily attributed to gasoline prices (+2.9 percentage points) and food and non-alcoholic beverages (+1.2 percentage points). Additionally, the end-of-period core inflation, which excludes food and energy, totaled 2.0 percent compared to -0.4 percent in June of 2021. The 12-month average inflation rate reached 3.4 percent at the end of June 2022, continuing its upward path. Nonetheless, the real exchange rate for the Aruban florin vis-à-vis the U.S. dollar trended downwards during the first half of 2022. This downward trend is a result of consumer prices in the United States rising faster than those in Aruba.

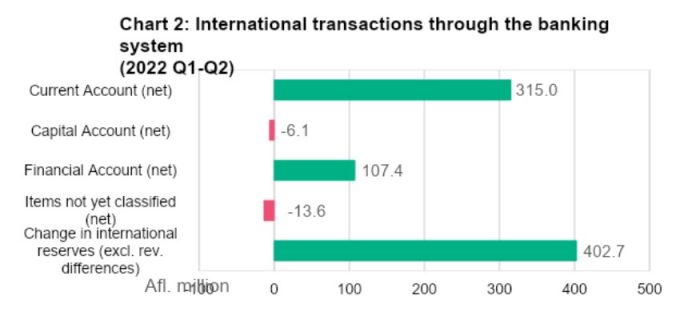

International transactions settled through the banking sector resulted in a significant net inflow of foreign exchange of Afl. 402.7 million pushing the level of international reserves to Afl. 3,286.8 million ( incl. gold and excl. revaluation differences) (Chart 2). Both the current and financial accounts of the balance of payments contributed to this outcome, recording net foreign exchange inflows of, respectively, Afl. 315.0 million and Afl. 107.4 million. The significant rise in international reserves stemmed from a net inflow of tourism revenues registered at commercial banks and government foreign borrowing via a loan agreement with the Netherlands to finance maturing external debt in 2022. Consequently, the level of international reserves remained adequate and well above the benchmarks monitored by the CBA.

In the first half of 2022, based on available information, the Government of Aruba’s (GoA) fiscal deficit dropped to Afl. 16.8 million, Afl. 313.3 million less than in the same period of 2021. This contraction was due to a decline in government expenditures (-Afl. 161.6 million) and a robust increase in government revenues (+Afl. 151.2 million). Despite the revenue growth noted in the first half of 2022, it remained below the 2019-level (90.3 percent of 2019 figures), indicating that there is still a gap to bridge before reaching full recovery.

In June 2022, government debt reached Afl. 5,969.0 million, up from Afl. 5,655.6 million in December 2021. An expansion of Afl. 243.5 million in foreign debt caused this higher debt stock. The debt-to-GDP ratio increased by 0.6 percentage point and stood at 101.7 percent in June 2022 compared to the end of 2021.

The complete publication is available on the CBA’s website. (https://www.cbaruba.org/document/state-of-the-economy).